|

|

|

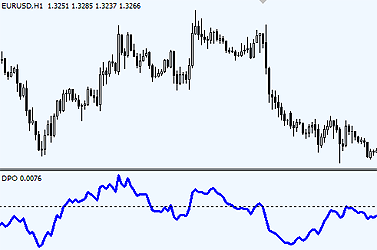

Detrended Price Oscillator (DPO)

Detrended Price OscillatorDetrended Price Oscillator (DPO) is an indicator for eliminating trends in prices. Detrended Price Oscillator (DPO) indicator is used to isolate short-term cycles, from long-term cycles. How DPO indicator does it? How to trade with DPO indicator

DPO trading During Trending Markets Identify a trend and trade in the direction of the main trend. Buy when DPO hits zero from above or dips below zero for a while and then goes up above zero. Sell when DPO hits zero level from below or even crosses above zero for a while and then turns back below zero. DPO trading During Ranging Markets Identify overbought and oversold levels individual for every currency pair based on the past price behavior. Buy after DPO dips below an oversold zone and then exits from it closing above the oversold zone. Sell after Detrended Price Oscillator enters an overbought zone and then exits from it and closes below the overbought zone. DPO indicator formula

|

DPO signals long trades when it crosses above the zero line;

similar to this, DPO signals short trades when it crosses below the zero line.

Additional strategy is to look for a divergence between DPO indicator and price on the chart.

When indicator makes a higher low and price at the same time makes a lower low - we have a bullish divergence.

When DPO makes a lower high and price makes a higher high - it is a bearish divergence.

hello...what is the different between DPO and dinapoli oscillator

You're talking about the same indicator. No difference.

Another great explanation with a very powerful indicator! Overbought & oversold are somewhat subjective so I added a 13 LWMA signal to the DPO 13. Now I watch for earlier of the crossing of the signal or the zero line. Absolutely fantastic! Thank you very much!

good indicator

what's up??? the numbers on the side of the Dinapoli are 0.0021 and -0.0017 so what are the line numbers I need to add? Same with the DPO the numbers are 0.0051 and -0031 plus the 0.000 is not in the center. Really worthless

[email protected]

Post new comment