|

|

|

Stochastic RSI

Stochastic RSI basicsStochastic RSI was developed to increase sensitivity and reliability of the regular RSI indicator when it comes to trading off overbought/oversold RSI levels. The authors of the Stochastic RSI indicator - Tushard Chande and Stanley Kroll - explain that often regular RSI indicator would trade in between 20 and 80 levels for extended periods of times without ever reaching an oversold/overbought areas where many traders seek trading opportunities. When combining RSI with Stochastic, a new indicator - Stochastic RSI - provides better and more distinctive signals to trade upon. Let's compare regular RSI and Stochastic with their new improved version - Stochastic RSI:

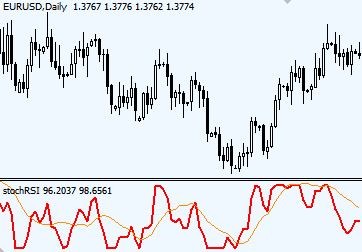

As we can see, unlike other indicators Stochastic RSI was able to reach overbought/oversold levels all the time and even remain there longer before moving in the opposite direction. Let's now take a closer look at the overbought/oversold levels created by Stochastic RSI:

How to trade with Stochastic RSIWhen trading with Stochastic RSI traders look for the following signals: 1. Trading with Stochastic RSI oversold/overbought levels: When StochRSI exits from oversold (below 20) level up - Buy. Notice, that unlike with RSI, where we used 30 and 70 levels as oversold/overbought, here we use 20 and 80, same as for Stochastic indicator.

Another point to notice is that we react to indicator signals only after d% line (the thin brown line on the screen shot) has reached overbought/oversold levels as well. If, this line has never entered the overbought/oversold area, any signals to Buy/Sell as StochRSI exits 20 or 80 should be temporarily ignored. 2. Crossover of the center line of StochRSI suggest a current trend. These are the two most effective ways to trade with Stoch RSI, the rest, such as divergence trading, for example, would be less effective with this indicator opposed to regular Stochastic and MACD Stochastic RSI formulaStochastic RSI = ((Today's RSI - Lowest RSI Low in %K Periods) / (Highest RSI High in %K Periods - Lowest RSI Low in %K Periods)) * 100 Stochastic RSI measures the value of RSI in relation to its High and Low range over the required period: Comments |

Thank you for the Stochastic RSI downloads.

What settings did you use in your screenshot examples?

For StochRSI.mq4 it is:

For StochRSI_basic.mq4 it is:

Such a good indicator..but unfortunately i could not download it..when i press the downloads, the page appears some kind of code of the indicator..im not sure what to do with it..can u please help me

Azim

To download an indicator from Forex-indicators.net

1. Right click on the indicator link

2. Choose "Save as" or "Save link as" to download the indicator.

Thanks man=D

by the way, what do you recommend for exiting the trades?i mean how many pips should i take profit?

Thanks a lot,

Azim

That's impossible to suggest. It would depend on:

- time frame

- currency pair

- the stop loss distance

What are the setting for M1 time frame?

Rey.

Anything from default settings to a smaller number you can come up with. It's all about testing, and will depend on the currency pair & volatility factor as well.

Thanks for this tool.

can not be downloaded

Use Right click + Save as...

the indicator cannot apply to the chart

Follow these steps to install/attach the indicator:

http://forex-indicators.net/how-to-install-mt4-indicators

Good work, please what should be the signal of the this indicator in order to exit a trade? and is this indicator lagging or leading?

from Kc

How can we use it in expert advisor?

I guess: iStochRSI(???) but params are not clear.

Thx in advance.

Thanks for comprehensive and constructive explanations.

sidabumi

it best indicator ,i have been trading for 6 months

Stanley rotich

Great Indicator, I've been using it for 3 weeks now and love it, although I still use the rsi (for divergence only) and stochs, I like adding this into the mix. When I see it hitting ob / os I'll throw up stochs to see what they are doing and compare the two. Gret way to use as a filter to judge the validity of the ob/os signal and the momentum of the move.

why it not ALERT for trend UP? always n ONLY for trend DOWN...?

i beg to all please use this damn good indicator...

possible to code signals when rsi leaving the overbought, oversold area?

Yes, Why it doesn't alert for trend up, I tried on backtesting on my live account, always alert for trend down but not for trend up, some corrections / addition needed, I guess. Could Fxindicator or anyone add that alert there. Thanks. Manoj

Hey, can you tell me an indicator which keeps you out of ranging markets?

Which setting to use this indicators, i have follow your custom StochRSI_basic setting, which best?

Post new comment