Download: ATR.mq4

Download: ATR.mq4

Download: ATR_histogram.mq4

Download: ATR_histogram.mq4

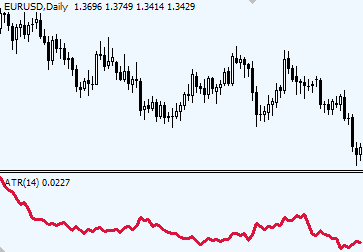

Developed by Wilder, ATR gives Forex traders a feel of what the historical volatility was in order to prepare for trading in the actual market.

Forex currency pairs that get lower ATR readings suggest lower market volatility, while currency pairs with higher ATR indicator readings require appropriate trading adjustments according to higher volatility.

Wilder used the Moving average to smooth out the ATR indicator readings,

so that ATR looks the way we know it:

How to read ATR indicator

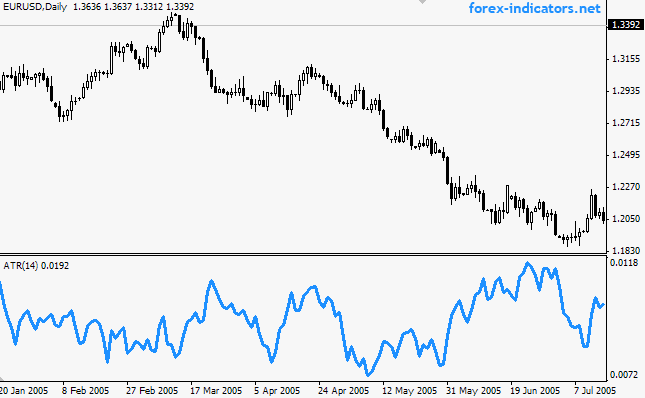

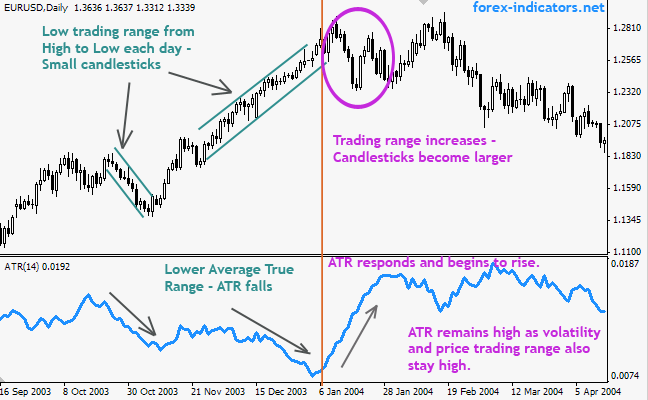

During more volatile markets ATR moves up, during less volatile market ATR moves down.

When price bars are short, means there was little ground covered from high to low during the day, then Forex traders will see ATR indicator moving lower. If price bars begin to grow and become larger, representing a larger true range, ATR indicator line will rise.

ATR indicator doesn't show a trend or a trend duration.

How to trade with Average True Range (ATR)

ATR standard settings - 14. Wilder used daily charts and 14-day ATR to explain the concept of Average Trading Range.

The ATR (Average True Range) indicator helps to determine the average size of the daily trading range.

In other words, it tells how volatile is the market and how much does it move from one point to another during the trading day.

ATR is not a leading indicator, means it does not send signals about market direction or duration, but it gauges one of the most important market parameter - price volatility. Forex Traders use Average True Range indicator to determine the best position for their trading Stop orders - such stops that with a help of ATR would correspond to the most actual market volatility.

When the market is volatile, traders look for wider stops in order to avoid being stopped out of the trading by some random market noise. When the volatility is low, there is no reason to set wide stops; traders then focus on tighter stops in order to have better protections for their trading positions and accumulated profits.

Let's take an example:

EUR/USD and GBP/JPY pair. Question is: would you put the same distance Stop for both pairs? Probably not. It wouldn't be the best choice if you opt to risk 2% of the account in both cases. Why? EUR/USD moves on average 120 pips a day while GBP/JPY makes 250-300 pips daily. Equal distance stops for both pairs just won't make sense.

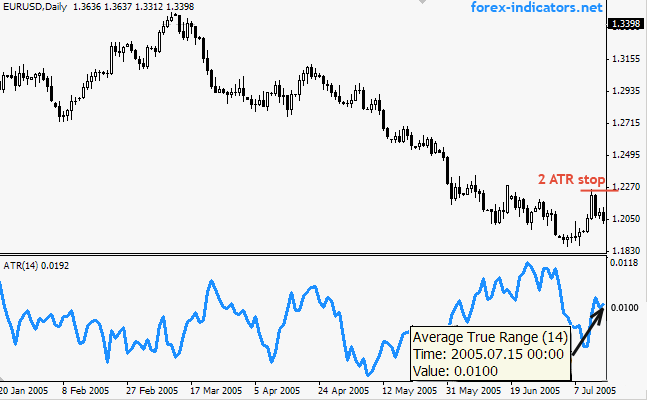

How to set stops with Average True Range (ATR) indicator

Look at ATR values and set stops from 2 to 4 time ATR value. Let's look at the screen shot below. For example, if we enter Short trade on the last candle and choose to use 2 ATR stop, then we will take a current ATR value, which is 100, and multiply it by 2.

100 x 2 = 200 pips (A current Stop of 2 ATR)

How to calculate Average True Range (ATR)

Using a simple Range calculation was not efficient in analysing market volatility trends, thus Wilder smoothed out the True Range with a moving average and we've got an Average True Range.

ATR is the moving average of the TR for the giving period (14 days by default).

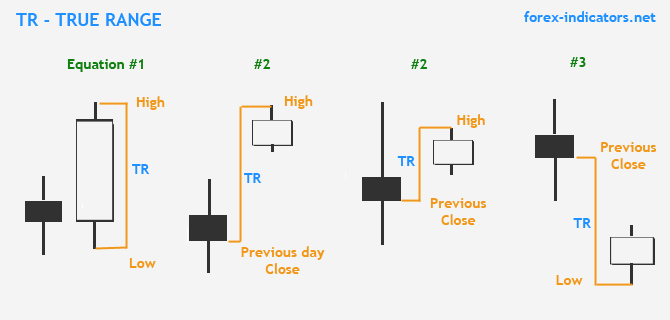

True range is the largest value of the following three equations:

1. TR = H – L

2. TR = H – Cl

3. TR = Cl – L

Where:

TR - true range

H - today's high

L - today's low

Cl - yesterday's close

Normal days will be calculated according to the first equation.

Days that open with an upward gap will be calculated with equation #2, where volatility of the day will be measured from the high to the previous close. Days which opened with a downward gap will be calculated using equation #3 by subtracting the previous close from the day's low.

ATR method for filtering entries and avoiding price whipsaws

ATR measures volatility, however by itself never produces buy or sell signals. It is a helping indicator for a well tuned trading system.

For example, a trader has a breakout system that tells where to enter. Wouldn’t it be nice to know if the chances to profit are really high while possibility of whipsaw is really low?

Yes, it would be very nice indeed. ATR indicator is widely used in many trading systems to gauge exactly that. How?

Let's take a breakout system that triggers an entry Buy order once market breaks above its previous day high. Let’s say this high was at 1.3000 for EURUSD. Without any filters we would Buy at 1.3002, but are we risking to be whipsawed? Yes, we are.

With ATR filter traders follow next steps:

- measure ATR for the previous 14 days (default) or 21 days (another preferred value);

- for example, we’ve found that EURUSD 14 day ATR stands at 110 pips.

- we choose to enter at breakout + 20% ATR (110 x 20% = 22 pips)

- now, instead of rushing in on a breakout and risking to be whipsawed, we enter at 1.3000 + 22 pips = 1.3022

- we give up some initial pips on a breakout, but we’ve taken an additional measure to avoid being whipsawed in a blink…

ATR for support/resistance level crosses

Same approach as for above method with whipsaw filters, applies to entries after a trend line or a horizontal support/resistance level is breached. Instead of entering here and now without knowing whether the level will hold or give up, traders use ATR based filter. For example, if support level is breached at 1.3000, one can Sell at 20% ATR below the breakout line.

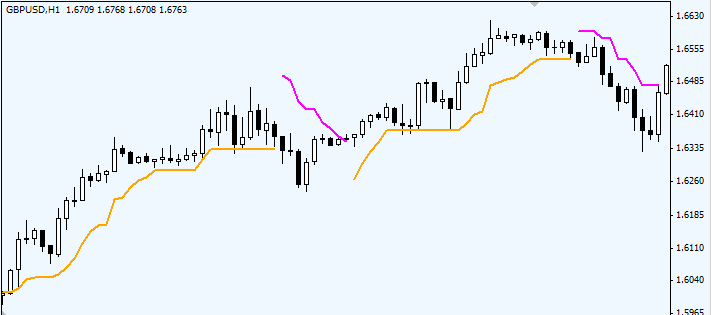

ATR for trailing stops

Another common approach to using ATR indicator is ATR based trailing stops, also known as volatility stops. Here 30%, 50% or higher ATR value can be used. Using the same range of 110 pips for EURUSD, if we choose to set 50% ATR trailing stop, it’ll be placed behind the price at the distance of: 110 x 50% = 55 pips.

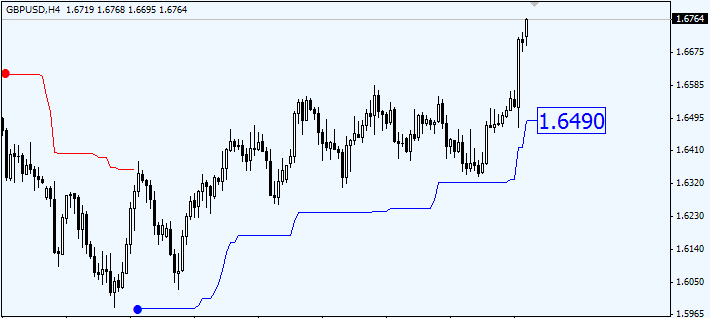

ATR based indicators for MT4

Due to high popularity of the ATR volatility stops study, traders quickly put the theory to practice by creating customized Forex indicators for Metatrader 4 Forex platform:

VoltyChannel_Stop.mq4

VoltyChannel_Stop.mq4

ChandelierExit.mq4

ChandelierExit.mq4

Copyright © Forex-indicators.net

Comments

The best description of ATR I have seen so far.

Thank you.

the guides are excellent and well done. compliments

How to apply 10 ATR value to at USD/JPY currency pair.

It seems it gives the values that I do not know how to translate.

Please check and inform me as well.

davidjohny[]yahoo.com

excellent website. very good explanation of the indicators

ATR values are set in pips so for JPY pairs (i.e. USDJPY, EURJPY, GBPJPY) you multiply with 100 and for pairs that aren't JPY then you multiply the value with 10000.

Great description, thank you!

thanks

Nice explanation..........

With regards

kawser

good job, this post helped me alot

thanks

As a newcomer to Forex Trading I found this explanation clear and helpful. Very valuable content overall.

ATR IS THE BEST INDICATOR IN FOREX? ANY ONE TELL?

Well explained. Now I get it!

Detailed enough explanations.

Thank you, thank you once again!

This really inspires to write more!

ATR is one of the most recognised indicators when it comes to defining absolute maximum yet logical stops, as well as predicting the length of the rally after a breakout.

Nice and to the point!

Agreed! Well done. Thank you! The pictures are great.

Outstanding presentation! Thanks!!

It was the first time I could understand what it was. T. You

hello my incredible and savvy teacher, i would like to ask that is it possible to use ATR with small time frames, say, with 1 hour and 30 minute time frame or less?

Thanks million beforehand

Baha

I BELIVE YOU HAVE JUST PUT THE LID ON MY FOREX TRADING, AND ACROSS THE BOARD TRADING. ALL TRADERS NEED TO USE THE ATR INDICATOR, FOR THEIR CANDLE RANGE. ALL YOU HAVE TO FIND IS THE DAILY TREND! EUREKA!!!! THE BULB COMES ON NOW!!!!!!!!!!!!!!!!

THANK YOU,

FAT PAT!!!

Glad I found your site. I've been having some success with ranging markets, but needed theory dealing with identifying trends. You offer concise, easy to understand explanations of the forex tool-kit. I will definately be accesing this site regularly.

Thanks,

Jim

I was really looking for a way to reduce whipsaws in my trading system, and that description and guide certainly helped me a lot. Thanks a lot. I'll try implementing this strategy into my EA.

Best Regards ! Where from can I download Average True Range ? Thank you very much !

Got it ! 10X !

Can u explain the ATR based indicators for MT4 a little more? What am I actually lookng at? Can this be used in any time frame?

VoltyChannel_Stop.mq4

ChandelierExit.mq4

Tks.

Post new comment