|

|

|

Commodity Channel Index (CCI)

Indicators built around CCI:

Additional CCI indicators:

Commodity Channel Index (CCI)

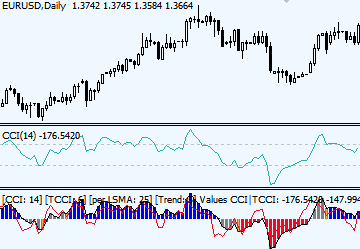

There is a variety of CCI indicators, just by looking at the screenshot below with various CCI versions, it becomes understandable - there is huge package of trading methods behind each simple and custom CCI indicator.

Fundamentals of trading with CCI indicatorDeveloped by Donald Lambert, original CCI consists of a single line which oscillates between +/-200. The author advises to use CCI for entries and exits once CCI reaches +/-100. It goes as follows: Since 1980 when CCI indicator was first introduces, traders have found lots of ways to interpret CCI and expand trading rules. all those methods and views will be cover here. CCI and its Zero lineAn aggressive way to enter the market is to react to CCI's line crossing its zero level.

Simple rule: unless, we have reached an oversold/oversold zone. CCI overbought & oversold zones

With CCI we can separate indicator readings to 3 zones: 1. Already known, a zone above Zero (bullish) and a Zone below zero (bearish). Trading rules: when price crosses zero line, Buy/Sell depending on the direction of a crossover. 2. An overbought zone - CCI reading above +100, an oversold zone - CCI reading below -100 Once price moves higher above +100, a strong uptrend has been established. Hold on to a Long position, but prepare to exit as soon as beautiful tall candlesticks yield place to smaller reversal candles with long shadows and small bodies. 3. An extremely overbought zone - CCI reading above +200, and an extremely oversold zone - CCI reading below -200. Take profit & close trades. Prepare for a price reversal. Summary: CCI indicator signals

Bonus: CCI trading Walk-throughWith what we know so far, we can already read and trade with CCI indicator.

1 - CCI is in an overbought zone. The moment it entered there, we could have placed a Buy order, since we know that a strong uptrend has been established. 2 - CCI rises to an extremely oversold level, this is where we know that the reversal is near, so the measures are to tighten our stop loss and either exit as we spot a reversal pin bar candlestick or wait till CCI exits below 200. 3 - The moment CCI exits +200 zone we should close all remaining Long trades and look to Sell. With CCI exiting from an extremely overbought zone is a perfect opportunity to initiate our first Short trade. At the same time, should we never witness CCI above 200, we'll be still holding our Buy position open, because CCI continues to trade inside an overbought zone. 4 - As price exits from an overbought zone, we close all Long positions and can immediately open Short positions / add to existing Short trades opened at point 3. 5 - CCI crosses its Zero line and now is on Seller's territory. We can open yet another Short trade. 6 - Price enters an oversold zone (below -100), which tells us that a downtrend is already running strong. We can add up to a Short trade and hold till we find that CCI rises back above -100.

Comments |

I do think you have seriously consider building this website, comparing to Babybips but I felt this is much better education than babypips.com because you have demonstrated simple, shortcut, straightforward and easy to understand.

I do like babypips.com but sometimes they can be overwhelmed with the information. Please you can improve your website and I am sure more people will visit you.

Good luck.

Thank you for your feedback!

I'll do my best to improve it; just unlike with huge websites which have several people behind them, I'm working on this website alone. Thus, I admit I'm doing a much slower progress at the moment. Thank you for your support!

Can the cci be effective for scalping in 5 min or 1 min charts

CCI on 5 or 1 min - not a problem, if you want to scalp you can sure use it.

THANK YOU!

This is GREAT STUFF! I LOVE YOUR CCI Histogram MATCHED UP WITH THE SNIPER SIGNALS!

I thought I would mention this site is very nicely laid out, and is a resource I think I'll be returning to frequently. This is my first visit.

i cannot thank you enough for these explicit information. I now understand forex indicators better. Thumbs up!

Always my pleasure!

please ,i have a question, how does one use the i-panel multi-time frame indicator. i downloaded it from this site and i like it but feared i might use it wrongly. thank you for your kindness.

I'd need to make a separate page for it.

I might be able to do it by the end of this week. Please check back later.

Please visit new page with iPanel indicators explained

where are the choppy zone indicator and sidewinder indicator? i can't find them in the RealWoodieCci.mq4. but anyway this website is great!!

Thank you!

I have only this SideWinder_Overlay.ex4 for CCI sidewinder.

The choppy zone indicator I don't have, I'm sorry. I have Choppiness_index.mq4

I really like this indicator and see how useful it can be. i am currently using it to trade the daily. i havent tried it on any other period. Should I be using or could I use it on the 15 and 60 minute chart?

CCI can be successfully used across all time frames: from monthly to 1 minute.

You can be a position trader or a scalper, CCI indicator will always give you the edge in your trading analysis.

Thank you for your simple but clear information. This is indicator is great but but rarely used in forex classes.

Your site is amazing. Thank you for sharing your knowledge. I was using the CCI before coming to your site but, not to its fullest potential. You have helped me to use it in a very positive way. I have tried a couple of the CCI variations you have on your site and I am very impressed with the results I get with the FX_Snipers charts. I like understanding the underlying principles for charts which is why I have to come to your site. Do you have more info about the FX_Snipers charts? Yours is the only place I have even been able to find these indicators (and how grateful I am to have found them).

I can't thank you enough for taking the time to explain all these indicators so well to us. I believe in the concept that knowledge is the most valuable thing you can have and you have provided much of that knowledge. Great work and great site.

Thank you for creating such a fantatic resource of valuable and useful information. Your site, even though you are not a huge site, is the best ive found after visiting many many such sites! WELL DONE!

Thank you for this information, it is very important but I have little concern, I tried to download CCI_Histogram.mq4, but i canot, can any one tell how I will fix this issue?

Tnx

Right click + Save as... will do the job.

good luck!

Thanks good one

Great site and a real help to me, I am just starting fx trading

Thanks a lot

GB

You are really great man.. I never had forex info like this.. simple and compact. I will tell all my trader friends about this website. (sorry for my english not good) =)

Great site, many thanks

Just one question: how many periods do you recommend? the default on my CCI is 14, yet you have 34 and 50.

Post new comment