|

|

|

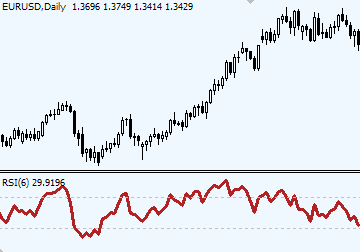

Relative Strength Index (RSI)

Introduction to RSI indicatorRelative Strength Index (RSI) - is another great momentum indicator developed by Welles Wilder. Standard period settings for RSI is 14 periods, which can be applied to any time frame. Read entire post >>> |

Because once RSI advances above 70 it is not yet a signal for an immediate Selling, since RSI may stay in overbought area for a long-long time. In fact, when a strong uptrend develops, readings above 70 are just a beginning of a great upward move. That's why you should buy if your technical analysis shows evidence of a strong trend ahead.

now i have got a good direction

trader

Thank you for sharing these ideas. I am newbee trader and you just supported my enthusiam and strengthened my confidence.

Please continue being so open with your insights for people like me to learn.

Congratulations to you, may your tribe increase!

I am looking for the rsi to have the ability to change the colours of the levels. for example 30 as green line for buy zone entry and 70 as red for a sell zone entry. Is there one like this or can/do you guys create them for people.

Here is one: Color_RSI_v1.02.mq4

under momentum indicator, which 1 is better?? CCI or RSI 14???

Many traders would give preference to CCI indicator.

Great lesson; can I use RSI (14) on M1? Thanks

Yes, but longer period RSI might be better, compare to RSI 50, for example.

Divergence at bottom of trend can be misleading as downtrend is killed after multiple divergences.Best is take position when price is above 5 ema plus divergence of good magnitude is printed.

Man. This is a great site

While trading Forex, please give me 5 most tested & trusted Indicators which shoul be available of trading sceen and might help me in making profitable trading.

B P Sinha

HOW CAN I USE THE RSI IN OPTION DAY TRADING. WHICH RSI IS BETTER RSI 14 OR RSI 6

If the price increases to a level where the rsi is at 90 they would only buy if a longer term rsi is still below this level. Check it out at http://www.forexright.com/the-relative-strength-index/

AWESOME website your great.

Is there a solid reason behind the standard 14-day default period for RSI? Everywhere I read mentions that Wilder suggests the 14-day period for RSI but no explanation is ever provided as to why. Knowing why would provide a trader with insight as to whether or not it should be used for that trader's specific purposes.

Because Wilder said so in his book.

thus everybody uses it as a default setup/parameter

LoOOL

They are insanely crazy. They put a Copyright on a content originally delivered by J.Welles Wilder Jr section VI. Page 65 of New Concepts in Technical trading systems

Please, Can this system work effectively in 1h Time frame....Am a Newbie

I was doing as mentioned in an earlier post: Using a cross of a shorter and longer RSI. Then I noticed something: That the shorter RSI coming out of OB and OS worked as good or better. Specifically, I now set RSI to 4 and my OB & OS at 70 and 30. When used with a couple of other filters it is very effective.

cool!

I have found RSI for the 9 period most useful in conjuction with a Stoch of the same perid. On 4H charts (forex). I mainly use the RSI to spot divergences before reversals and a fib trend line to use for entries and targets from the previous swing low or high.

There seems to have been no mention up till now of the 9 period, are there any other users?

like it

very well explained

Which rsi period is better and not fakesignal..

Post new comment